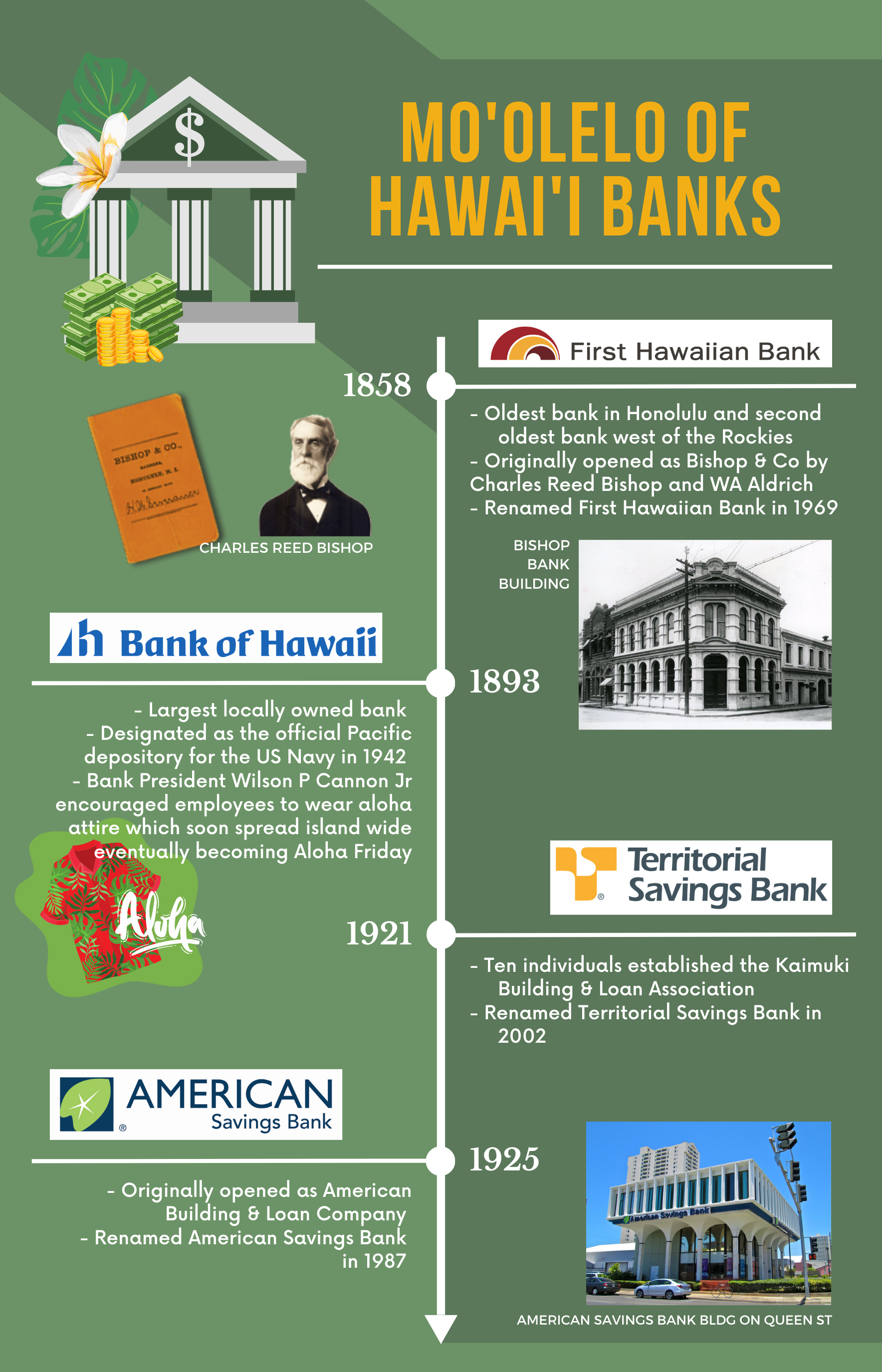

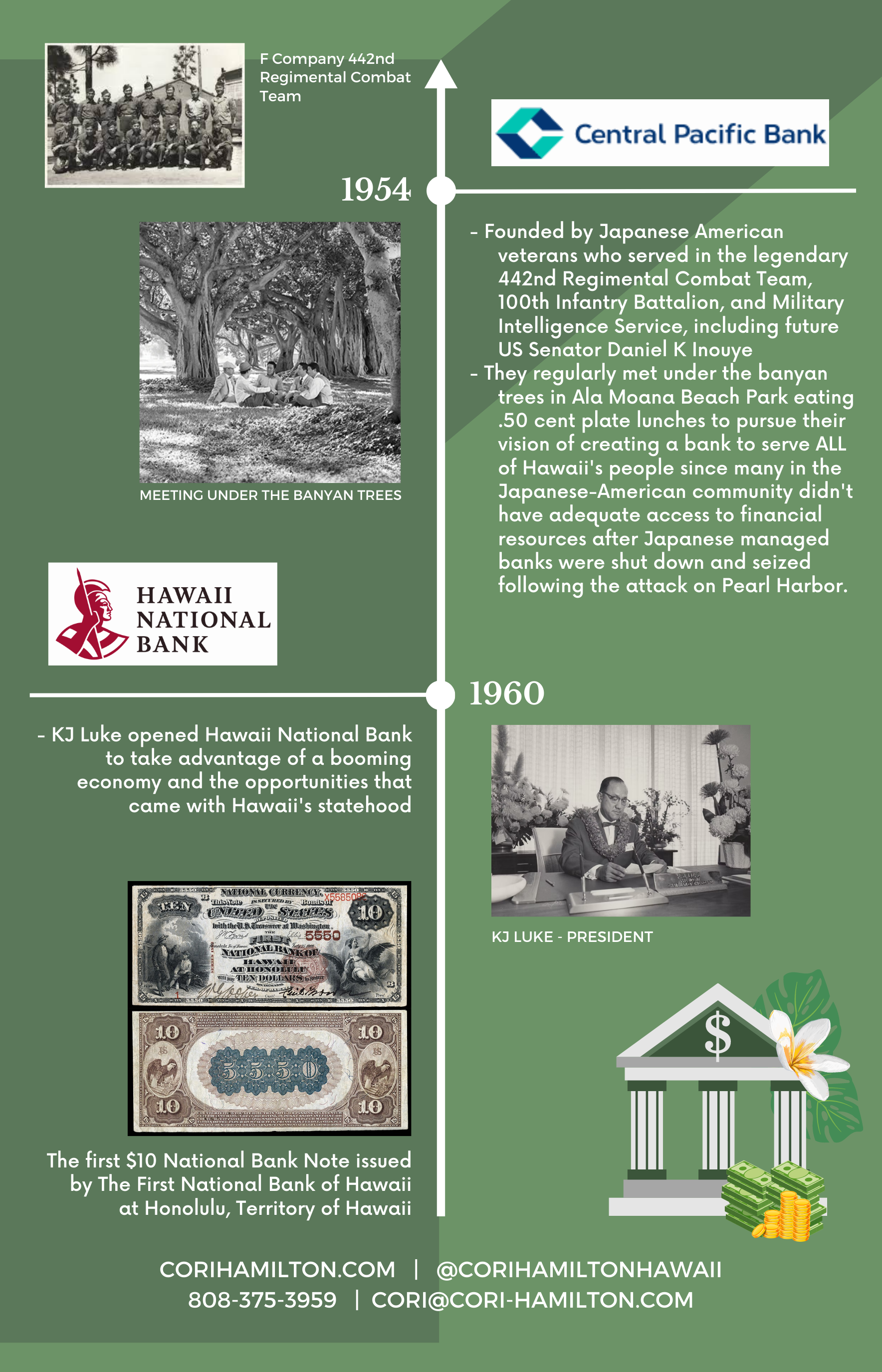

The Heat is On: How Rising Mortgage Rates Are Impacting the Spring Housing Market

The sun is shining, flowers are blooming, and the spring housing market is heating up—right? Once the market cooled off at the end of 2022, real estate experts predicted the 2023 housing market to warm up in the spring months. However, as inventory remains low and mortgage rates rise, some people are starting to fear another housing market crash.

Not to worry! I’m here to tell you why that isn’t the case. Keep reading to learn why you shouldn’t fear the worst for the 2023 housing market.

Let’s look back at 2008

1. Slipping Mortgage Standards

Looking back at the statistics in 2008, it’s easy to see that nearly anyone could get a mortgage for a home they couldn’t afford. Banks were creating artificial demand by granting loans with few restrictions. This led to many homeowners defaulting on their loans and ushering in a new wave of foreclosures. The economy took a huge hit from all these loans crumbling beneath faulty restrictions—and luckily, the mortgage industry has taken many steps to learn from their errors in the past.

2. Overflowing Inventory

Because of the banks’ artificial demand, homes were being built right and left for anyone who would buy them. Then, once the foreclosures hit the market, there were too many homes and insufficient demand—forcing national home prices to plummet at an alarming speed.

So, what’s the deal today?

1. Unsteady Interest Rates

Many experts predicted the mortgage rates to ease off at the end of 2022 and into early 2023, but the recent hikes in the market are starting to turn some heads. These increasing mortgage rates are still a direct result of increasing inflation.

The Feds are keeping a close eye on the rates as they continue to assess the nation’s inflation. So, it’s possible to see the rates yo-yo up and down throughout the beginning of the year as the Feds decide when to conclude the uptick in mortgage rates.

2. Sellers Are “Rate Locked”

What do we mean by “rate locked”? A large portion of the nation’s homeowners are sitting on a mortgage rate around 4% or lower, and they are hesitant to enter the market and swap their rate for the current percentage. This has contributed to another shortage of inventory as we ease into the warmer months of the year.

How can this benefit you?

As we compare the current market trends to the housing bubble of 2008, it’s clear that we are tackling much different hurdles—and luckily, these seem to be temporary trials. Experts foresee the mortgage rates leveling out throughout the year as the market picks up in the spring and summer months.

And as for home prices, we are still experiencing a shortage of inventory. As long as demand outweighs supply, you can expect your home to continue to appreciate, even if it’s at a slower pace than the last few years.

Buyers. We’re seeing an influx of buyers pull out of the market now that the interest rates are peaking once again. However, this is a great opportunity to hunt for a home while there’s less competition. And with so many builders offering new-build incentives, now is a great time to sneak into the market while the waters are calm. Lisa Sturtevant, Chief Economist at Bright MLS, spells out the mindset of today’s buyers:

“For some buyers, higher mortgage rates will be a hurdle but ultimately will not keep them from getting back into the market after sitting on the sidelines for months.”

Sellers. Whenever there’s an inventory shortage, you can always expect the market to work in your favor. With less people willing to sell, you will stand out to prospective buyers. Jeff Tucker, Senior Economist at Zillow, says:

“. . . sellers who price and market their home competitively shouldn’t have a problem finding a buyer.”

All in all, the increase in mortgage rates have caused some waves in the housing market, but we expect the market to settle into calmer waters as the year progresses. If you are looking to buy or sell your home in the coming months, it is always beneficial to work with an experienced agent to guide you through the ups and downs of the market. Contact me! I’m happy to assist with your real estate needs.

How to Stick to a Budget

Do you have financial goals but don’t know where to start? Setting a budget is the first step to financial success. However, many people will create a budget and fail to stick to the parameters they’ve put in place.

So much for a budget, right?

If managing money is not your forte, consider these five tips to keep you on track:

(Click the photo above to watch my Youtube video!)

- Budget as a Team

If your budget affects more than one person, could you include them in the budgeting process? This keeps you and all involved parties on track to achieve the same financial goals. Set a dedicated time every month—or even quarterly if you’re a pro—to check in and reassess your spending habits.

- Expect Monthly Differences

Let’s be honest; not every month in the year is created equal. To stay on top of your budgeting, try to predict when you will spend more significant amounts due to certain life events. Do you have a month that’s a little birthday-heavy? Summer vacations? Don’t forget those new clothes and back-to-school supplies in August! You know your lifestyle better than anyone else, so try to predict the expenses and budget for them ahead of time.

- Start with the Essentials

When deciding where to funnel your earnings, consider life’s top four essentials. Everyone requires food, shelter, utilities, and transportation. These four necessities in life should be prioritized when creating a budget. After meeting these needs, you can get creative about where to distribute the rest of your funds.

- Don’t Set it and Forget It

Once you create a budget, it’s common for people to set it aside and let it collect dust. However, your budget should adapt to your lifestyle changes. Did you get a promotion? Congrats! You can now adjust your budget to reflect your new financial goals and lifestyle. Did you have an unexpected medical expense? You might need to reflect on your budget and see how to adjust and accommodate.

- Online Budgeting Tools

While I love a great Excel Sheet as much as the next person, there are helpful apps and software programs that can keep track of your budget for you. Take a look at apps such as Mint, EveryDollar, and Goodbudget to craft a budget in a pinch!

Setting a budget is the first step in a long road of financial possibilities. Believe in yourself and know you can create positive habits that will help you succeed in the future.

If owning a home plays a part in your financial goals, I am happy to assist you when the time comes! Real estate is an excellent investment, and I’m here to help you achieve your financial and homeownership dreams!

8 Things To-Do When Moving To or From Hawai’i

Let’s paint a picture.

You’ve just finished a mighty game of Tetris with the moving boxes, the family waves goodbye to a house once-called home, and you’ve all settled in for a long plane trip. It’s official! You’re moving out of state.

Moving can be a stressful time, but relocating to or from the islands is a trans-pacific adventure and very different than moving on the mainland. From packing, understanding the wooden lift vans, and shipping your car, then the journey to your new community—but surprise! A few things might have slipped your mind.

No need to worry! Here are 8 things to add to your to-do list when moving:

1) Visit Your Future Destination. It’s always a good idea to get the lay of the land when it comes to your future home. Drive the neighborhood streets and map out the closest schools, parks, grocery stores, and gas stations. These are important features of everyday life, and having a better understanding of your future surroundings will offer an easier transition.

2) Change Your Billing Address. Don’t forget to switch all your bills to the proper address. Not sure where to start? Here are some examples to remember:

- Utilities. Gas, water, electricity, and even garbage pickup! Most of the companies that offer these services vary by state. Tip: I can help! Ask me for a list of recommended vendors on Oahu.

- Credit Cards. Most people opt for online billing payments, but if you’re one of the few who prefer paper statements, don’t forget to update your address for your credit cards.

- Insurance. Moving could be a good opportunity to start shopping for local rates. If you’re looking for a new insurance source, now could be a good time to switch for a more competitive price.

3) Voter Registration. It’s easy to forget about this item on a to-do list, so don’t put it off until it’s too late! A new state means a whole new pool of political candidates.

4) Pet Registration. Yes, pets need to be registered with the state. Each city varies regarding how many furry friends (and which types) you can include in your humble abode, so make sure that you are registered and up to date.

5) Forward Your Mail. Don’t let your favorite magazine subscriptions and family Christmas cards get lost in the mail! Make sure to set up a mail forward with the post office before moving away. USPS will forward your mail to your new address for up to a year. Here is the link to inform USPS of your change in address: https://moversguide.usps.com/mgo/disclaimer

6) Look for New Wi-Fi & Cable Companies. Take a look at what your future neighborhood provides and get your home set up. Trust me, people will be asking for your Wi-Fi password the minute those neighbors come over for a backyard BBQ.

7) New Driver’s License. Each state’s deadline varies when it comes to switching over your driver’s license. Research what your new state’s requirements are before you officially relocate.

8) Get to Know Your Neighbors. The car and boxes are in, the dust has settled—it’s time to get out and meet some people! Introduce yourself to your neighbors or sign-up for the local gym or rec club. One of the easiest ways to meet people is through a mutual activity or hobby.

As your local Oahu Realtor, I’m here for you, no matter where your next adventure takes you. Reach out to me to get connected here on Oahu or anywhere in the country!

3 Steps to Planning Your Year

Entering a new year can be overwhelming. Just like an artist’s empty canvas or a writer’s blank sheet of paper, it’s hard to know where to begin. But remember, starting fresh also offers an abundance of opportunities. Now is the time to take your year by the horns and steer it in the right direction.

Don’t know where to begin? The following 3 steps are a great place to start:

Step 1: Setting Intentions

Setting your intentions at the beginning of the year is like making a map. Without them, how will you know where you’re going? Or, more importantly, how will you know when you get there? It’s hard to find the “X” that marks the spot if you don’t know what you’re looking for.

Okay, pirate lingo aside, it’s important to lockdown your annual goals at the beginning of the year. These intentions will help you stay on track whenever you’re feeling lost.

TIP: Write them down in a planner, on a Word document, or even in the notes app on your phone. Make sure your intentions are documented somewhere so you can always refer to them.

Step 2: Creating SMART Goals

Do you have your intentions in mind? Great! Now, let’s dig a little deeper.

We want to turn these intentions into SMART goals. This is an acronym meaning goals that are specific, measurable, achievable, realistic, and timely. Adding these parameters will provide clarity for your objectives and help you achieve the future you desire.

Goals that are specific and measurable help you narrow your intentions and track your progress (that way you know whether you’ve reached your milestones or not.) Next, be sure to set goals that are achievable and realistic. There’s nothing more discouraging than setting a goal that you secretly know you won’t achieve. And lastly, make sure you can reach these objectives within the year.

Now your 2023 is REALLY starting to take shape!

Step 3: Choosing Your “Word” for the Year

While we believe in the power of setting future goals, that may not be for everybody. Instead, consider a word for the year.

Think about your intentions for the year and narrow them down to a single word or phrase. No need for something fancy. How about—inspire? Or maybe reset? Choose something that you would consider meaningful for your year to come. The book One Word That Will Change Your Life by Jimmy Page & Dan Britton covers this idea in detail, so consider giving it a read as you establish your word for the year!

Have we turned you into a goal-getter yet?

Don’t forget that setting real estate goals is an important part of planning your year. If your real estate goals for 2023 involve buying, selling, or investing in a home, please text or call me at (808) 375-3959 or send an email to cori@cori-hamilton.com.

7 Reasons Not to Fear The Current Housing Market

Will the real estate market crash? Are the headlines as bad as it reads? Should you buy a house now or wait? These are questions our team has been getting a lot lately! We know the current market can seem overwhelming, but the good news is you don’t have to face it alone!

As the market slows (btw: totally normal for this time of year!), you may have questions about what will happen next. After all, memories of the Recession that took place in 2008 are still very fresh for many of us! This is why our team is tracking top economists and the latest market data, so we can provide you with sound advice as you prepare to navigate these changes.

Whether you’re a buyer or seller, click here to watch a quick video on why you shouldn’t fear the housing market this fall!

If you are a buyer:

1.) There is less competition – more homes on the market means fewer offers on each home, so you won’t have to come up with crazy ways to entice the seller to pick you.

2.) There is room to negotiate – some sellers are offering concessions like paying part of a buyer’s closing costs or helping buy their rate down.

3.) You don’t have to waive your inspection and financing contingencies, which gives you the flexibility to call the deal off if issues arise. A luxury many buyers didn’t have last year!

4.) You have more options, which makes the process of looking at homes fun again.

If you are a seller:

5.) You can still benefit from the enormous appreciation in home values we have seen over the past 2 years.

6.) You are still in a seller’s market and will sell your home quickly – 88% of recently sold homes spent less than a month on the market.

7.) As long as you have a trusted professional to help you strategically price your home, you will still get a lot of interest from buyers.

Plus, if you are wanting to not only sell, but also purchase a new home, you will benefit from all of the above!

Something to keep in mind: The National Association of Realtors (NAR) reported an increase of 100,000 members since 2021. The average experience of NAR agents has decreased to only 8 years. Who knows how long these agents will last in a shifting market—that’s why you need to trust a professional with the skills and experience to get you to the closing table!

The ever changing real estate market can be overwhelming! We know what it takes to guide you through investing, selling, or finding your dream home. Contact me today to learn more about our local market!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link