The Mo’olelo of The Night Marchers

There is hardly an uncle or aunty on the islands that has not heard of the ancient spirits that roam the islands and rule the night. Their supernatural tales instantly generate chicken skin and that sudden chill down your back.

This is the mo’olelo of the Night Marchers.

Night Marchers, or Hukai’pō, are armed warriors adorned in brilliant costumes of ages past that continue their job in the afterlife that they performed in their former lives – protecting ali’i (chiefs) who were so sacred that the common man was never allowed to look at them. The consequence of disobeying this kapu (taboo) was death. In life, kindly chiefs supposedly took to traveling at night to avoid being spotted by commoners and subsequently leaving a bloodbath everywhere they went.

Night Marchers, or Hukai’pō, are armed warriors adorned in brilliant costumes of ages past that continue their job in the afterlife that they performed in their former lives – protecting ali’i (chiefs) who were so sacred that the common man was never allowed to look at them. The consequence of disobeying this kapu (taboo) was death. In life, kindly chiefs supposedly took to traveling at night to avoid being spotted by commoners and subsequently leaving a bloodbath everywhere they went.

They can be recognized by their torches in a single file, chanting, thunderous pahu drums, and sometimes even theblowing of the pū, or conch shell, as a warning as they march. That’s when you know it’s time to run and hide. If you find yourself in their path, avert your eyes, strip naked and lie face down and play dead. (Some rumors say that peeing on yourself will keep you alive as the Marchers will move on from one they believe is mad.) No matter the scenario, you must hope that the ghost warriors take mercy on you. If not, you’ll hear a shriek of “o-ia!”, which means, “let them be pierced,” and that will be the end of you. If you are fortunate to have a distant ancestor among the warriors, they’ll shout “na’u”, which means “mine”, and the procession will pass you by without any harm.

They can be recognized by their torches in a single file, chanting, thunderous pahu drums, and sometimes even theblowing of the pū, or conch shell, as a warning as they march. That’s when you know it’s time to run and hide. If you find yourself in their path, avert your eyes, strip naked and lie face down and play dead. (Some rumors say that peeing on yourself will keep you alive as the Marchers will move on from one they believe is mad.) No matter the scenario, you must hope that the ghost warriors take mercy on you. If not, you’ll hear a shriek of “o-ia!”, which means, “let them be pierced,” and that will be the end of you. If you are fortunate to have a distant ancestor among the warriors, they’ll shout “na’u”, which means “mine”, and the procession will pass you by without any harm.

Ultimately, it would be smart to avoid them completely. Night Marchers are said to march on the last four Hawaiian moon phases before the new moon, and only after sunset and before the sun rises. They often frequent sacred grounds, such as heiau (temples), caves, and areas once reserved for ali’i. There are dozens of known Night Marcher trails all over O’ahu, including Ka’a’awa Valley, Yokohama Bay, Kaniakapūpū, Ka’ena Point, Kalama Valley, Waimānalo, and more.

Whether you believe these legends or write them off as a local superstition, consider yourselves warned…

The Mo’olelo of the ‘Awapuhi Kuahiwi

If you’ve gone hiking around Hawai’i, then you might have come across a curious-looking plant with a beautiful, bright bloom. Locally known as ‘awapuhi or “shampoo ginger”, this plant originated in India and migrated through Polynesia before early settlers brought it to Hawai’i. Every single part of this plant was used in ancient Hawai’i from cooking to medicinal uses, and body care.

The most popular use for ‘awapuhi today is as a shampoo. The thick, slightly sudsy extract can be squeezed out of the flower and applied directly to your hair. It repairs dry and damaged hair, nourishes the scalp, and helps to bring out the shine of your hair. Paul Mitchell (from the famous hair care line) was so captivated by the benefits of ‘awapuhi that he established a self-sustaining ‘awapuhi farm in Hawai’i in 1983 to produce the plant for use in his line of hair care products.

‘Awapuhi is also known by other names, such as pinecone ginger, bitter ginger, and wild ginger. It can be found in many beauty products today but for centuries it has been a standard in traditional Hawai’ian beauty care.

Dreaming of Places Far, Far Away: New Coldwell Banker Data Shows High Rate of Out-of-State Searches

Dreaming of Places Far, Far Away: New Coldwell Banker Data Shows High Rate of Out-of-State Searches

By Athena Snow

Fresh Coldwell Banker data from the Move Meter℠ reveals where Americans are dreaming of moving

MADISON, N.J. (July 6, 2022) – This summer, as Americans enjoy their favorite activities to cool down, dreams of moving are heating up. Fresh data from the Move MeterSM on the refreshed coldwellbanker.com shows trends and insights into where Americans are dreaming of moving, giving sellers an informative, clear picture about the potential of listing their homes. In fact, 82% of all Move Meter℠ searches to date were looking to move out of state.

The Move Meter℠ compares cost of living city by city. It was created by Coldwell Banker Real Estate as part of a suite of industry exclusive tools to allow consumers to dream of home and guide them to their new destination. In addition to the Move Meter, Coldwell Banker has created the ultimate destination for home sellers at coldwellbanker.com, with industry exclusive tools like the CB Estimate℠, which provides a home value estimate, and a remarkable new Seller’s Assurance Program.

Americans are on the Move (Meter)

- Going the distance: The average Move Meter℠ search covered 1,015 average miles (about the distance of New York to Miami).

- Eighty-two percent (82%) of all Move Meter℠ searches were looking to move out of state.

- On the flip side, Massachusetts had the greatest proportion of searchers considering staying in-state, with 40% of all searches from Massachusetts looking to stay loyal to the Commonwealth.

- Only about 13% of all searches were looking within a driving distance of 100-miles from their origin destination with the highest proportion of moves being somewhere between 500 to 1,500 miles away (42%).

- Chasing Sunshine: While Midwesterners and Northeasterners are looking for warmer temps in the Southeast (38% vs 46%), Southeasterners, Southwesterners and Westerners all had higher likelihoods of staying local to their respective regions.

Americans are dreaming of moving – but where to?

- Southern Charm: Austin, Texas, topped the chart as the most searched destination to move to, and had 46% more searches than the next closest destination. The top locale dreaming about moving to Austin is San Diego, California. So how does the move stack up? According to the Move Meter℠, the move from San Diego to Austin could be a smart move if you value job market strength

- California Dreamin’: 20% of searches from California were looking to stay in the Golden State. The top in-state searches looking to move somewhere else within California were from San Diego, San Francisco and Bakersfield.

- And for those looking outside of California, where were they dreaming about? Californians are looking to Texas, Florida, Tennessee and Washington overall, with Austin, Dallas, Seattle and Nashville having the greatest move appeal outside of California.

- Burnin’ Up for Florida: The #1 state topping the Move Meter℠ interest index was Florida with one out of seven of all Move Meter℠ searches looking to move to the Sunshine State.

- The top states looking to soak up the Florida sun included New Jersey, California, New York, Illinois, Ohio and Massachusetts. Where in Florida are these searchers looking? Sarasota, Miami, Naples, and Tampa were the most popular searched cities.

- Floridians don’t disagree – they, too, see the appeal, as they were one of the top states searching for destinations within the state as well, with a quarter of Floridian searches looking to stay in-state.

- The other top states Floridians are searching was North Carolina and Tennessee.

- Destination Dreams: The top 10 searched cities included Austin; Sarasota, Florida; San Diego; Denver; Nashville, Tennessee; Tampa, Florida; New York; Naples, Florida; Charlotte, North Carolina; and Seattle.

With a network of over 100,000 agents across the globe, Coldwell Banker has affiliated agents in nearly every market in the United States. So, no matter where searchers are looking, a Coldwell Banker affiliated agent can help make the dream come true. Home sellers and buyers can visit coldwellbanker.com to find an agent and prepare for their next move to their dream home using the coldwellbanker.com/movemeter.

CLICK TO TWEET:

QUOTES:

“Our new Move Meter℠ tool provides insights into where American’s are looking to make their dream moves. Since 1906, Coldwell Banker has served as the leading innovator in real estate, with agents in nearly every market in the US, we provide the tools and the resources sellers need to help make their dreams come true, wherever their search takes them. If you’re looking to make that big move – let our Coldwell Banker agents guide you there.”

- Ryan Gorman, CEO of Coldwell Banker Real Estate LLC

“Through the new tools on coldwellbanker.com, we’re seeing a strong interest and desire in Americans and homeowners to take a leap of faith and relocate to live in their dream destinations this summer. The Coldwell Banker Move Meter℠ provides sellers with the support and tools they need to make those dreams become a reality.”

- David Marine, CMO of Coldwell Banker Real Estate LLC

About Coldwell Banker Real Estate LLC

Powered by its network of over 100,000 affiliated sales professionals in approximately 2,200 offices across 40 countries and territories, the Coldwell Banker® organization is a leading provider of full-service residential and commercial real estate brokerage services. The Coldwell Banker brand prides itself on its history of expertise, honesty and an empowering culture of excellence since its beginnings in 1906. Coldwell Banker Real Estate is committed to providing its network of sales professionals with the tools and insights needed to excel in today’s marketplace and is known for its bold leadership and dedication to driving the industry forward. The brand was named among the 2022 Women’s Choice Award® Most Recommended brands for customer experience and overall quality. Blue is bold and the integrity and values of Coldwell Banker give the Gen Blue network an unbeatable edge. Coldwell Banker Real Estate LLC fully supports the principles of the Fair Housing Act and the Equal Opportunity Act. Each office is independently owned and operated. To join Coldwell Banker Real Estate and unlock the possibilities of Gen Blue®, please visit www.coldwellbanker.com/join.

About AnywhereSM

Anywhere Real Estate Inc. (NYSE: HOUS) is on a mission to empower everyone’s next move. Home to some of the most recognized brands in real estate – Better Homes and Gardens® Real Estate, CENTURY 21®, Coldwell Banker®, Corcoran®, ERA®, and Sotheby’s International Realty® – the AnywhereSM portfolio includes franchise and brokerage operations as well as national title, settlement, and relocation companies and nationally scaled mortgage origination and underwriting joint ventures. Supporting approximately 1.5 million home transactions in 2021, Anywhere is focused on simplifying, digitizing, and integrating the real estate transaction for all consumers, no matter where they may be in their home buying and selling journey. With innovative products and technology, Anywhere fuels the productivity of its approximately 196,200 independent sales agents in the U.S. and approximately 136,400 independent sales agents in 118 other countries and territories. Recognized for eleven consecutive years as one of the World’s Most Ethical Companies, Anywhere has also been designated a Great Place to Work four years in a row, named one of LinkedIn’s 2022 Top Companies in the U.S., and honored by Forbes as one of the World’s Best Employers 2021.

The Mo’olelo of the Oahi (Hawaiian Fireworks)

Whether you love them or loathe them, it’s hard to imagine Independence Day without fireworks. From the first celebrations of our nation’s independence, fireworks have played a major part in the festivities, but our new country wasn’t the first to use “fireworks” in celebration of important events.

In ancient times Hawaiian royalty would celebrate special occasions with the oahi (fire-throwing) ceremony which involved throwing flaming embers from high atop the sea cliffs on Kauai’s north shore. The lit firebrands were thrown out over the ocean into the strong seaward winds where they would be caught in the updrafts.

Oahi, meaning rocket or fireworks, required months of preparation. Two kinds of wood were used, the hau and the papala. The hau was easy to get and was cut into ten- or twenty-foot lengths with the bark peeled off and then dried until it was as light as a feather. The papala grew in the high mountains and was hard to get so it became the king’s special fireworks. It had a hollow core when dry, so the flame ran through it as it fell, giving the effect of a shooting star.

These dried sticks were carried up the high cliffs to a ledge 1000 ft or more above the sea. At night the men would light the ends of the sticks and hurl them like javelins into space. The concave cliffs forced the trade winds upward forming a sort of air cushion allowing the blazing hau sticks to rise and fall. The combination of the wind and gravity fanned the burning end into a blazing ball of fire as the stick danced in the air and away from the cliff until it reached the outer edge of the air cushion where it would plummet, blazing fiercer and fiercer, until it rushed out to sea.

The Mo’olelo of “Ka Mele ‘O Ke Anuenue” as told by Darrell Aquino

Ka Mele ‘O Ke Anuenue is a mele composed for Harold Kano’eau Delatori. He was a young man who passed away at an early age. Harold’s friend, Kekoa Yap, wrote this song in his memory. Harold was from Lahaina, Maui and the rainbow (anuenue) represents him in the mele.

Harold was a brother-in-law to me. Kekoa is a Kumu Hula (master hula teacher) and one of my granddaughters was a haumāna (student) in Kumu Kekoa’s halau. My granddaughter was entered into a hula competition and was chosen to hula for this song. I had the opportunity to help compose the music for this song and perform it at the competition. I later chose to record the song after the competition because of the wonderful feedback we were getting from the performance.

The mele was then entered into the Na Hoku Hanohano Awards and was a finalist in the category of “Hawaiian Single of the Year”. It was exciting for me to present this song to the public and to my peers for the family of Harold who is beloved by many. Though it did not win the award, our family found it to be a privilege and honor to be recognized by the Hawaii Academy of Recording Arts.

Lyrics:

| Aia i ka uka ‘O Lele

Ke ānuenue pi’o i luna Ka wehi ‘O Hālona Hoapili ‘O ka ua pā’ūpili e Ua pono no kou waiho’olu’u Ha’a le’a a puni ‘O Pu’u kukui Kū ha’o i ka makani Ma’a’a Nānā ‘ia e Kihawahine ‘Ike ‘ia e ke lehulehu Lei ia ko waiho’olu’u I ka pu’uwai hāmama ‘O nā kupa, o nā kini, o kēia ‘aina e Ha’ina ‘ia mai ka puana Ka mele ‘O ke ānuenue Lei lua’ole ‘O Lāhainā Ka wehi o ke kuahiwi ē He Mele Inoa, a he Mele Lei no Kano’eau |

There in the uplands of Lele

The rainbow arches on high The adornment of Hālona Companion of the Pā’ūpili Rain Your colors are righteous Dancing about Pu’u Kukui Standing firm in the Ma’a’a winds Seen by Kihawahine Seen by the multitudes Your colors are worn as a lei Warming the hearts Of the people, of this land

Tell the refrain Of the rainbow’s mele Incomparable lei of Lāhainā An adornment of the uplands |

About Darrell:

Darrell is my favorite Hawaiian musician! His family is near & dear to my & Mike’s hearts! He has performed for us at several family & professional events over the years.

His career has taken him across the islands and around the world. He’s been honored with multiple awards and performed with many international artists. He currently performs in a band at various venues across the islands as well as solo/duo performances.

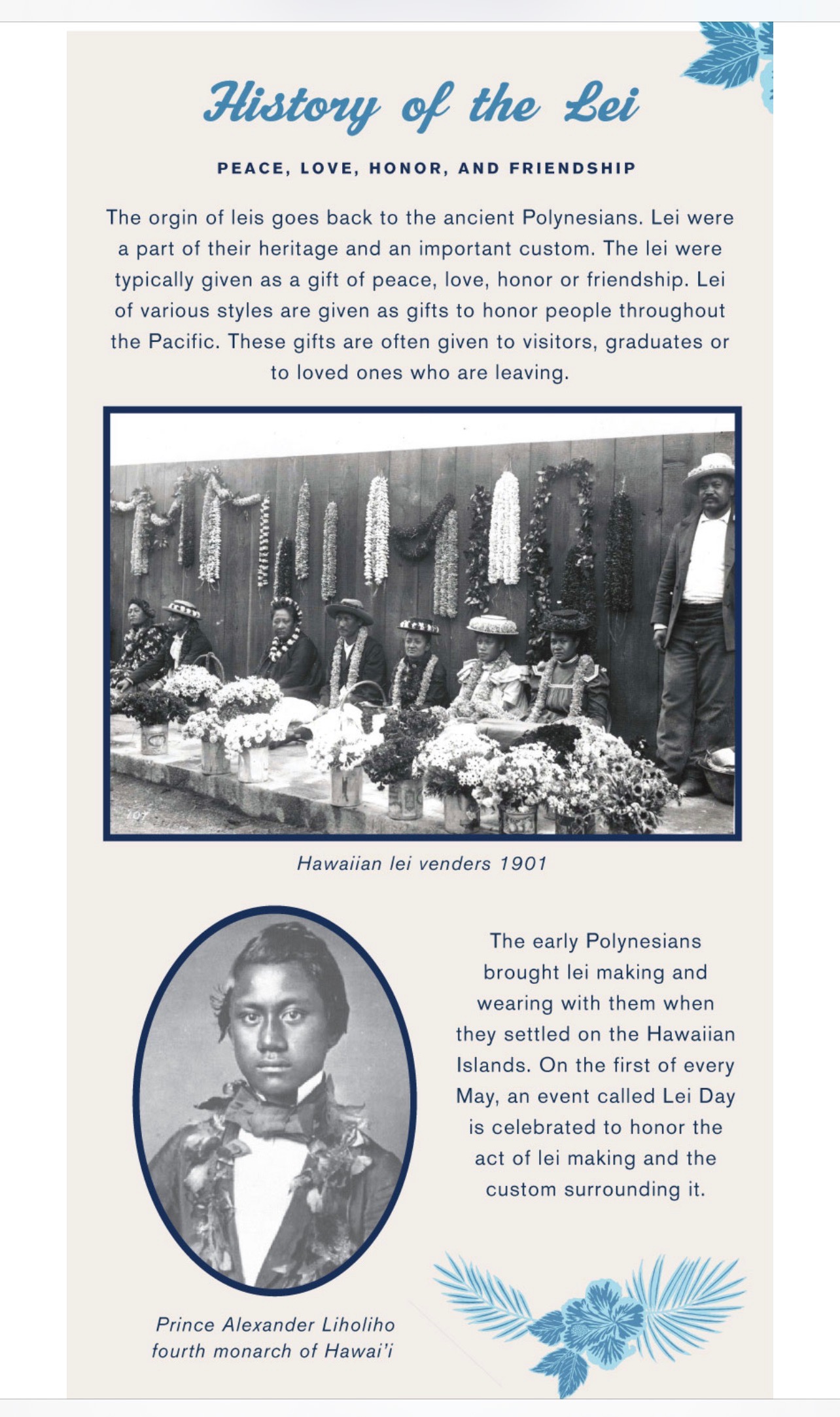

The Mo’olelo of the Lei

It’s said that lei custom was introduced to the Hawaiian Islands by early Polynesian voyagers. Lei were garlands worn about the neck constructed of flowers, leaves, shells, seeds, nuts, feathers, and even bone and teeth of various animals. In Hawaiian tradition, lei were worn by ancient Hawaiians to beautify themselves and distinguish themselves from others.

During the “Boat Days” of the early 1900s, lei vendors lined the pier at Aloha Tower to welcome malihini (visitors) to the islands and kama’aina (locals) back home. It is said that departing visitors would throw their lei into the sea as the ship passed Diamond Head, in the hopes that, like the lei, they too would return to the islands again someday.

Lei is so important to the Hawaiian people that on the first of every May, an event called Lei Day is celebrated to honor the act of lei making and wearing and sharing lei.

Lei can be made in a multitude of ways as well as in a variety of shapes, sizes, colors and meaning. Lei can be worn anytime by anyone on any occasion. To give a lei, it is presented to another by gently placing it around their neck, accompanied by a kiss on the cheek.

To wear a closed lei, it should be worn on the shoulders, half hanging on the front and the other half on the back. An open lei should be centered on the back of the neck with both ends hanging down on the front.

Don’t play with a neck lei by putting it on your head or wrapping it around your wrist as a bracelet. There are specific shorter lei to be worn on the head called haku, or for your wrists or ankles called kupe’e. The haku is often for special occasions such as weddings and graduations while the kupe’e are generally worn by dancers to draw attention to the graceful movements of the hands and feet.

If someone is pregnant, do not offer them a closed lei, as it’s considered bad luck to wear one (it symbolizes the umbilical cord getting wrapped around the baby’s neck).

Do not refuse a lei when offered one or remove your lei in the presence of the person who gave it to you as it is disrespectful. If you are unable to wear the lei for whatever reason including allergies or interference with your work, it is polite to discreetly take it off then hang the lei in a visible place of importance and honor.

A lei should never be thrown away in the trash as it is considered disrespectful. It is customary to return the lei to the earth. You can either remove the flowers from the string and scatter them in the ocean, bury them, or burn them. Or simply hang the lei on a door or window to dry it out to preserve it. Lei can also be hung from trees or left in a place with special meaning such as a statue or sacred site.

A lei should never be thrown away in the trash as it is considered disrespectful. It is customary to return the lei to the earth. You can either remove the flowers from the string and scatter them in the ocean, bury them, or burn them. Or simply hang the lei on a door or window to dry it out to preserve it. Lei can also be hung from trees or left in a place with special meaning such as a statue or sacred site.

The Mo’olelo of the Menehune and the Leprechaun

Name a group of small, mischievous, mythical, nocturnal artisans that love to sing & dance and are rarely seen by humans ….

Did you guess the menehune? You’re right!

Did you guess the leprechauns? You’re also right!

The legends and folklore differ between the menehune and leprechauns, but they share a lot in common. The details vary within their own histories, but it is commonly accepted that both groups were small compared to the average human and were not often seen by anyone unless caught by surprise.

The menehune people were a race of small native Hawaiians who inhabited the islands before the first settlers arrived from Polynesia. They spent their nights constructing legendary engineering feats in a single night before disappearing into the hidden forests and valleys. Their most famous creation is the Menehune Fishpond, also known as the Alakoko Fishpond, on the island of Kauai. The 900 ft wall in the pond was built to trap and raise fish for the ali’i (Hawaiian royalty).

Leprechauns are said to be skilled cobblers, a profession which provides them with their famous pots of gold. Those prized pots are hoarded and hid at the end of a rainbow where humans can try to catch them to barter their freedom for their treasure. But beware, those teeny dudes are known tricksters and it’s usually the human who ends up tricked! Keep your eyes open for rainbows and if you hear the sound of a cobbler’s hammer, there may be a leprechaun (and his gold!) nearby.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link