The Mo’olelo of a Royal Teacup

One late morning many years ago, I was visiting a kupuna very dear to my heart. We were sitting on her antique koa furniture in her living room sipping lemonade and discussing how she could reupholster her cushions without damaging the wood. After a quiet moment, my friend unexpectedly went to her china cabinet and lovingly removed a gorgeous antique yellow teacup. She carefully placed the stunning cup & saucer on the coffee table. The teacup was breathtaking. The sunlight shone through the fine porcelain illuminating the beautiful painted cherubs. We silently took in the beauty. I could see that my friend loved this teacup and the memories it brought her.

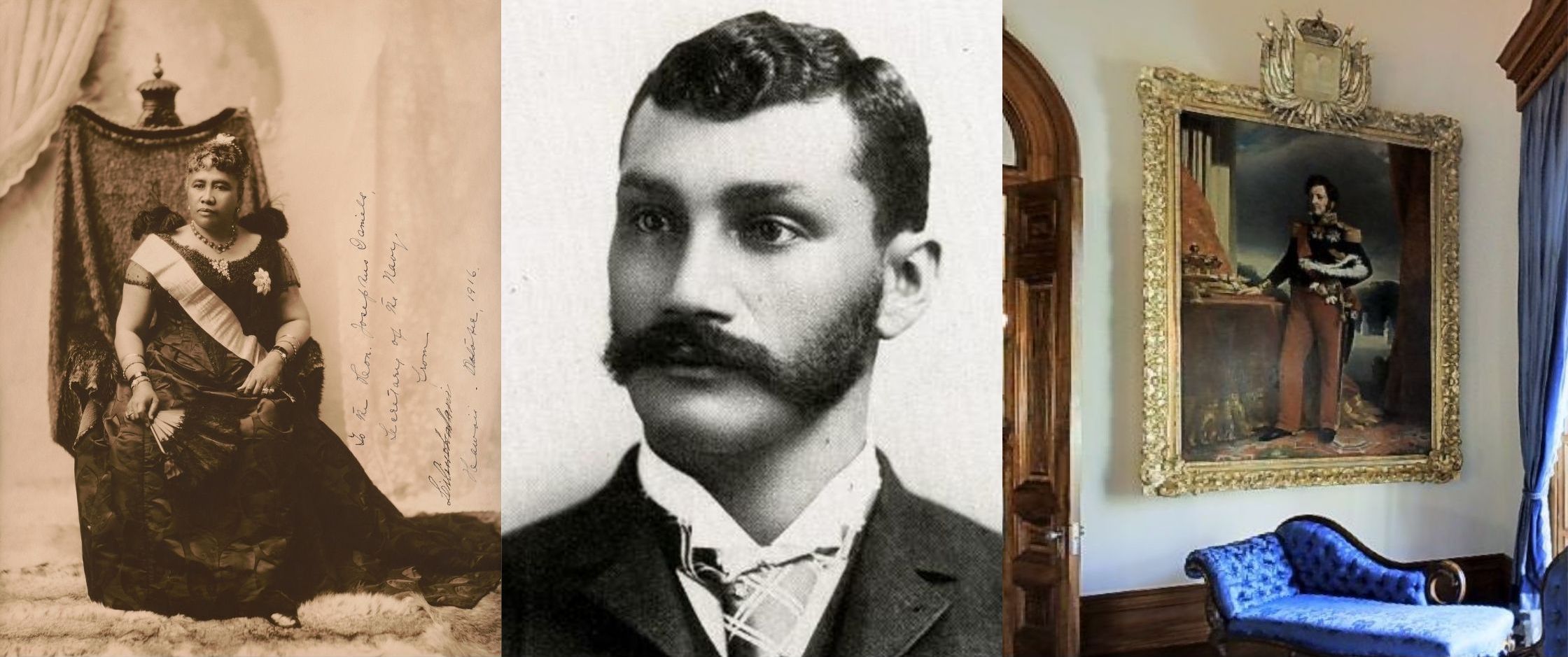

My friend’s grandfather was Abraham Kaleimahoe Fernandez. King David Kalakaua, Queen Lili’oukalani’s elder brother, was very close to Abraham’s parents and remained so until his death in 1891 whereupon Lili’uokalani was proclaimed Queen. Abraham was one of Queen Lili’uokalani’s most loyal royalists. Abraham was both a friend and a beloved counselor to the Queen. From 1891-1893 Abraham served the Kingdom of Hawai’i as a meer of the Queen’s Privy Council. My friend’s prized teacup belonged to Queen Lili’uokalani. The Queen gifted it to Abraham. Abraham gifted it to his granddaughter, my dear friend.

As you sip your Rose Lemonade tea, take a moment, and imagine … Imagine the mo’olelo this treasured royal teacup could tell.

French Connection to Hawaii

- Queen Emma, Princess Ka’iulani, Prince Kuhio, Kamehameha IV, and King Kalakaua all visited France at various times to help establish Hawaii’s presence in Europe.

- France gifted Kamehameha III a full-length portrait of King Louis Philippe that currently hangs in the Blue Room in ‘Iolani Palace. It’s the largest painting in the ‘Iolani Palace Collection. The huge portrait required 12 men to carry it from the ship in Honolulu Harbor to the palace.

- Father Damien, Hawai’i’s most renowned French missionary, was actually born in Belgium. He was, however, a member of the French Congregation of the Sacred Hearts based in Paris. Father Damien was sent from France, ordained in the Honolulu Cathedral of Our Lady of Peace in 1864, and assigned to Moloka’i in 1873 where he performed service he is most remembered for among the people with leprosy.

- In 1944, our infamous 442nd Regimental Combat Team along with the 100th Infantry Battalion – both units made up mainly of second-generation Japanese-Americans from Hawai’i – suffered hundreds of casualties while freeing the French village of Bruyeres. To this day, the citizens of Bruyeres love our 442nd. Our few remaining 442nd survivors continue to try to make the annual pilgrimage to Bruyeres.

Liens and Encumbrances Affecting Real Property

Liens and Encumbrances Affecting Real Property Ownership

by Dan Harkey

What is a Lien?

A lien is a legal right or claim against real property, referred to as a security interest. The lien is given or conveyed to a creditor (lender) to hold and possess until the loan is paid off. A debtor (borrower) will agree to convey a security interest as consideration for a loan.

Creditors/lenders are persons or companies who willingly make loans secured by a security interest in property. The creditor/lender has a recorded charging interest and claims against the collateral property.

A property owner/borrower agrees to willingly grant or convey a security interest in their real property by signing an instrument called a deed of trust or mortgage. As an agreed consideration for the loan, this document must be recorded in a public records office to establish a recorded lien position as a lien attached to a particular real property.

A lien refers to a monetary (money) claim that will be attached to a property by a recording instrument and becomes an encumbrance on one or more properties.

What is an Encumbrance?

An encumbrance refers to a legal claim or agreement to enforce rights and obligations relating to a property. The claims are against the property by an independent party such as a mutual property association, a court ordered lien, a municipal notification for substandard conditions, or a government agency. The claims restrict the unrestricted use of the property until the deficiencies are satisfied or negotiated into an equitable agreement of future actions. An encumbrance may be lifted, reconveyed, or modified.

There are dozens of events, instruments, actions, or agreements that may be recorded in public records creating either a lien or an encumbrance on the property. Here are a few:

1) An originally recorded tract map by the state of jurisdiction for the entire neighborhood.

2) Utility and other easements, government-mandated conditions such as historical property registries, long-term leases, agreed-on encroachments, air and subsurface rights, height, and view restrictions.

3) Mutual association by-laws, covenants, conditions and restrictions, entity ownership and partnership agreements, tenancy leases; and various public notices such as weed abatement, notifications of substandard conditions.

4) Lis pendens, property settlements by adverse parties, divorce decrees, subordination, non-disturbance, and attornment agreements (commonly abbreviated as an “SNDA”), parking easements, reciprocal parking agreements, signage easements, and memorandums of agreement or understanding.

5) Property taxes, federal or state tax liens, zoning laws, environmental regulations, Etc.

The lending industry sometimes uses the terms lien and encumbrance interchangeably. However, a lien is generally a recorded monetary charge against a property. All liens are encumbrances, but not all encumbrances are liens. They both create claims against the property that impact the ownership rights, processionary interest and transferability. All three restrict the free use until the claim is lifted, reconveyed, or modified.

Another option is for a new buyer or lender to accept certain identifiable liens and encumbrances on the property as part of the risk assessment attached to the agreed transaction. The buyer party may decide to take property ownership subject to the items or issues. Some liens and encumbrances may stay on the title and remain with the property. The property ownership may be conveyed to another party, by a negotiated purchase contract, “subject to” certain items remaining on the title. A new owner may or may not take steps to have some of the encumbrances removed.

Generally, lenders will not accept irrational restrictions. Some restrictions cloud the title and may be void as a matter of law. I once witnessed a deed that had a condition that the property could not be sold to a person of Asian descent. I also witnessed a deed that restricted future property owners from selling or serving alcohol. Fortunately, I did not make a loan or purchase that property.

Some encumbrances negatively affect free usage, desirability, and marketability. In some cases, the adverse effects might be significant enough that the title cannot be conveyed legally or transferred to another party.

Dozens of issues may create conflicts, such as disagreements in limited partnership ownership rights, claims of processionary rights, and many other problems. The purchasing party may not be able to convince a title insurer to provide a title policy on the conveyance. In some cases, a court process called a declaratory relief action might need to be filed so that the court can mediate and decide on the validity of the contested claim. In a court process, never expect a rational outcome.

How does a lien or encumbrance become attached to a property?

In the United States, we have a standardized government records system referred to as the municipal recorder’s office. Whether city or county municipality, the recorder’s office, has the task of maintaining public records and documents relating to real estate ownership and other public notices. Their job includes recording and preserving historical records and making them available to the public.

The recording process and public records management have been made more convenient with modern technology.

What is the purpose of recording documents

The purpose is to covey constructive notice to the public of recording documents and instruments that affect the chain of title. The objective is to access public records and provide a traceable chain of title documents attached to real properties. Interested parties may trace recorded documents for many years to determine ownership, liens, encumbrances, and whether they were voluntary or involuntary. Generally, recording statutes permit (not require) the recording of instruments that historically affect the chain of title to or possession of the real property.

Suppose a person fails to record an instrument that should have been recorded. Even though a recorded deed is not essential for a valid transfer, an unrecorded deed leaves the property vulnerable to other unrelated events and documents that can be recorded. Ignorance could cause another unrelated recorded document to take a senior lien or encumbrance position. The penalty is that the person may have difficulty with any subsequent conveyance action desired to prove ownership or status of the possessory interest.

https://www.boe.ca.gov/proptaxes/pdf/Ownership_DeedRecording.pdf

https://www.investopedia.com/ask/answers/100214/what-real-estate-documents-need-be-recorded.asp

https://en.wikipedia.org/wiki/Recording_(real_estate)

I recall a time in the past when only paper records existed. Then came what was considered a substantial improvement called a microfiche records database. Microfiche was a flat piece of film that contained microphotographs. These images were photographed and reduced from the original. The materials were made of plastic (acetate) between the 1930s and 1980s, then polyester after the 1960s. The film has a silver-gelatin emulsion coating on it. A single 4 x 6-inch sheet of the film may have many separate frames. Copies of documents would be obtained using a scanner and printing device. By today’s standards, this is an obsolete method in our world of instant information.

Public records may contain notices of encumbrance for both voluntary and involuntary rights and claims. Liens and encumbrances create clouds on the title that must be acknowledged and dealt with by the transaction procuring broker, purchaser, or lender. A purchaser or lender may accept the property with questionable conditions, remove it from the title, modify it, or reject it because the risk is too significant.

Each document recorded against the property may contain agreements, considerations, prohibitions, and risks that the borrower/lender must consider. A recorded trust deed may have 20-40 pages of legalese that the borrower should review, as should the borrower’s counsel, agent fiduciary, and prudent lender. The document may contain clauses such as a “due-on-sale,” “due-on-further encumbrance,” “default provisions,” or “representations and warranties” by the borrower.

https://www.law.cornell.edu/wex/deed_of_trust

Because of the tremendous complexity, the subject relating to various clauses in loan documents, which will generally create restrictions and prohibitions, should be addressed separately. I encourage interested parties to seek competent counsel advice.

The real estate or lending broker/agent has a fiduciary responsibility to assist the buyer/borrower in understanding all documents relating to a purchase or loan transaction. Below is a good review summary of fiduciary duties.

https://dre.ca.gov/files/pdf/The_Real_Estate_Brokerage_as_Fiduciary.pdf

Sometimes a property owner may record notices of change of ownership in public records that amend ownership status. An example would be changing or conveying the title of a property from “husband and wife as joint tenants” to a “revocable family trust.” Another example may be recording a divorce decree or a quitclaim relinquishing one’s ownership interest in the property to another party as part of a negotiated settlement.

As a matter of law, only the trustees of a revocable family trust can hold legal title to real property, not the family trust itself. A revocable family trust is a legal entity but cannot act on behalf of the trust without the trustee. The trust document is an agreement between the key parties of the trust.

What is a first, second, and third lien priority position?

Lien priority is related to the precise date and time when the document is recorded in the recorder’s office and when and where it becomes a matter of public records. When a document is recorded, it is date and time-stamped and affixed with a sequential recording reference number.

Example: If a borrower or their title company recorded three liens simultaneously on a single property, that would create a first, second, and third lien, regardless of the dollar amount of each lien. The first lien, or earliest recorded, is considered a senior lien, the second and third liens are junior liens, with the second lien senior to the third. After the documents are recorded and scanned into the public records, the person who recorded the document will receive the originals back in their possession. A title company, lender, or borrower who recorded the documents receives the original date and time-stamped documents with reference numbers for confirmation of validity and safekeeping.

What ensures the order of the recording to be considered a first, second or third? How do you know that the recorder did not mistake and record the documents out of order? You may request and pay for an insurance policy referred to as title insurance from an insurance carrier. The title insurance policy is intended to guarantee your lien priority position, without which the carrier may be required to pay an incorrect insured claim.

If you were to go to the recorder’s office, stand in line, and have your documents recorded, you should check the recording sequence yourself. But, generally, the recording of documents is done by a title company carrier as part of a sale or loan transaction.

Assume that a property is encumbered with a first lien of $500,000, a second lien of $100,000, and a third lien of $50,000! Assume all were recorded on a subject property properly. If the first lien is paid in full and the trustee records a reconveyance, that procedure will remove the first lien from public records. The second lien would become a first lien, and the third would become a second lien.

A reconveyance is a written form signed by the trustee that is recorded when the lien is paid in full and fully satisfied. The reconveyance shows publicly that the lien has been released and removed from public records. At the point of recording, the security interest is extinguished. Recording the reconveyance is usually done by a title company that is handling the title work for sale or refinance transaction.

Some states refer to the satisfaction of mortgage documents rather than a reconveyance, but they are essentially the same.

If you were to refinance the same property and replace all three liens into one new single loan, all three liens would be reconveyed by the trustees and removed from public records. A new recording of the single loan with a fresh date stamp and recording number would reflect the new first lien position. The system works well if, for a fee, a title insurer provides an insurance policy that guarantees the lien positions.

Voluntary vs. Involuntary liens:

A voluntary lien is a claim that a person or a lender has against a property of another as security for payment of a voluntary debt as agreed to by a borrower. The lien is attached to the property rather than the person. A trust deed or mortgage lien is voluntary. The lien involves legal claims on assets such as real property. An owner may not sell the property or convey title to a third party without acknowledging, dealing with, or extinguishing the lien.

The recorded notice that a lien exists is with the county or municipal recorder’s office. Recording any lien or encumbrance against the private property will cloud the title.

A party may cloud the title for involuntary claims by recording a lien against private property. The owner did not agree to the lien. But encumbering the property is a method to enforce claims for involuntary debts. This claim includes obligations such as local, state, and federal tax liens, a notice of substandard conditions, contractor claims for mechanics liens, Homeowners association dues, child support payments, and judgments from civil suits.

Liens may be consensual such as a real estate loan, statutory such as property taxes, or based upon court order. A judgment lien is the most dangerous because a judge can order a recording of a lien on one’s property, whether for rightful reasons or subject to objection.

Statutory skipping power in front of other liens:

California law regards lien priority as “first-in-time, first-in-right.” First in time refers to recording with a precise date and time-stamped number. California laws also allow exceptions for some types of liens whereby certain liens are given “skipping power” to the front of the line regardless of recording time. Front of the line means giving lien priority position preference over other recorded liens and encumbrances.

Government regulations permit certain liens to be advanced, so they become the senior priority to other liens. Mechanic’s liens, meant to ensure that tradesmen and contractors are timely paid, is an example of a priority lien with “skipping power.” This right is protected by the California Constitution and further enumerated in the California Civil Code (Section 3110 et seq.)

However, there are limits on the “skipping power” of mechanics liens. These relate to technical requirements such as when the construction began and the claimant’s process to enforce that lien. Even when the mechanic’s lien appears to have been “wiped out or extinguished” by a senior lienholder at a foreclosure sale, the lien is not automatically expunged. For more specific requirements for mechanic’s liens, the lender should consult with counsel knowledgeable about construction and mechanics lien law.

Other exceptions relating to “skipping power” may include issues relating to property taxes, special tax assessment districts, and in some states, homeowners, or mutual property associations.

A written lease agreement has a “first-in-time, first-in-right” priority. Lessees (tenants) who have written lease agreements recorded at the county recorder’s office that are date and time-stamped before recording the new trust deed will have a right to enforce the terms of the lease agreement and right of continued occupancy. The lessee’s rights will run with the property until the lease terms (rights) expire or are modified in writing by mutual agreement. Below is an instructive example.

https://law.justia.com/cases/california/court-of-appeal/4th/65/1469.html

Lien priority may be modified through written agreements:

There are many reasons to create written agreements that are intended to modify the lien priority by mutual understanding. One method is called a subordination agreement. This agreement makes the subject lien junior to another lien even though it was recorded earlier with an earlier date stamp.

A real estate lender may condition the approval of a loan upon a written modification of the statutory priority. A written agreement between the borrower, the tenant, and the lender may be required as a condition of approving and loan closing. A straight subordination agreement or a subordination, non-disturbance, and attornment agreement (SNDA) may be advised. Both agreements, when recorded, are encumbrances on the property.

In some cases, it is in the lender’s best interest to terminate the tenancy in the event of borrower default and completion of a foreclosure procedure. In this case, a straight subordination signed by the tenant would be appropriate. Any action causing a change in the chain of title may cause the lessee’s priority to be lost. If the lessee’s priority is lost, he could be given the notice to vacate and be kicked out of the property.

In some commercial transactions, the lender may wish to preserve the tenancy of credit tenants to preserve the property’s cash flow, stabilized occupancy, and capitalized value. A subordination, non-disturbance, and attornment agreement “SNDA” may be the appropriate document to record. SNDAs are agreements between a lessee (tenant), the lessor (landlord), and the lender defining certain rights and responsibilities. The SNDA will protect the lessee or tenant from being evicted if the owner (landlord) stops paying the loan payments to the lender(s), resulting in a completed foreclosure. Other parties may be affected, such new a purchaser of the property.

https://www.jdsupra.com/legalnews/snda-what-is-it-and-why-is-it-important-97709/

Modifying the rights and responsibilities of senior and junior lien parties:

An intercreditor agreement may be advised. The use of this agreement does not modify the lien positions between junior and senior lender creditors.

An intercreditor is a written agreement between two creditors intended to memorialize how their competing security interests are to be handled when each possesses liens (a claim or money charging interest) in a common borrower and secured property. This agreement is used between two (or more) senior/junior lenders to establish rights and responsibilities between each lender. The agreement typically provides that one lender’s lien is senior to the other regardless of when and in which order the liens were recorded.

In some cases, the actual agreement is a “subordination and intercreditor agreement.” This document allows two different lenders to “split up” the collateral so that both will be secured in an equal first or junior lien position for their collateral, subject to the terms and conditions of the agreement.

The intercreditor agreements, when recorded, are an encumbrance against the property.

If you find value in this article for you and your associates, please forward it to others that may appreciate the education. I am sure that the reader realizes the importance of competent counsel.

Thank You

Dan Harkey

Business & Private Money Finance Consultant

Cell: 949-533-8315

Email: dan@danharkey.com

Tax Deductions on Rental Properties

The 2018 Tax Cuts and Job Act introduced various adjustments for rental property owners that indicate that the business will be more profitable than it was previously. Since the details of how the federal tax changes affect individual property owners can vary, it is important to consult with a tax advisor who specializes in real estate. However, here are some of the new tax rules that would most likely effect rental property owners.

Landlords can deduct a big ‘bonus’ the first year

To the IRS, rental properties depreciate over time simply due to the wear and tear. This is a tax advantage for landlords, which can carry out over several years. Landlords can obtain a “bonus” depreciation deduction for the first year they buy a rental property. Previously, the deduction was limited to 50% of the property’s value. However, under the new tax law, that deduction was increased to a maximum of 100%, which could cover the whole cost of the property. This bonus deduction would be deducted from revenue, resulting in a loss in rental income in many situations.

However, it’s important to note that your property must meet certain criteria: 1) It must be available for rent between September 27, 2017 and January 1, 2023, and 2) the property must have a “class life” of less than 20 years for all or part of it. To take advantage of the additional depreciation, the property would need to be reclassified as a five-, seven-, or 15-year property, as most properties have a class life of 27.5 years. (A CPA can assist you with this).

Up to 20% of rental revenue can be tax-free

While rental revenue is subject to taxation, the tax act may provide landlords with a tax break of up to 20% of their rental income. Section 199A of the Internal Revenue Code allows some taxpayers to deduct qualified business income. There was some debate in the past about whether this applied to landlords, but the IRS clarified the situation, allowing a “rental real estate enterprise” to be recognized as a business.

Landlords can deduct more home improvements immediately

Landlords used to be able to deduct repairs to a rental property right away, but home improvements were depreciated over time. Despite the confusion about this, the tax bill eased the rules and the immediate deduction threshold for home improvements were increased to $2,500 per item under section 179. So rather than going through the lengthy depreciation procedure, money spent on renovations under $2,500 can be deducted right away.

One negative: Some landlord losses are now capped

When a property’s expenses exceed its rental income, it results in a loss. Owners of renting real estate could formerly take infinite losses on their properties. Now the new tax law restricts these losses to $250,000 for a single person and $500,000 for married couples. The good news is that because these limits are so high, most of the individual rental-property owners will be unaffected.

How to make the tax act work for you

For real estate investors, the new tax bill has provided great opportunities. It is very important for rental owners to maintain records of sales closing disclosures, purchase closing disclosures, refinancing documents, and any receipts related to the residence for at least three years.

Lastly, as mentioned above, if you are a rental owner, it is strongly recommended that you consult with a tax advisor who specializes in real estate to ensure you are making the most of these tax deductions.

Resource

What is Capital Gains Tax?

The income tax you pay on gains from the sale of capital assets, such as real estate, is known as capital gains tax. So, if you sell your home for more than you bought it for, you will almost certainly have a capital gain and thus be required to pay capital gains tax on your capital gain. Gains from the sale of your home are taxed in the same way as income and sales taxes. Due to the Tax Cuts and Jobs Act, which went into effect in 2018, the rules have changed slightly.

Who Pays Capital Gains Tax?

Capital gains tax is levied on all belongings and property that you sell for a profit, such as your house. You have a short-term capital gain if you sell your house in one year or less, and you have a long-term capital gain if you sell your house after owning it for more than a year. Long-term gains, unlike short-term gains, are subject to lower capital gains tax rates.

The Primary Residence Tax Exemption

Home sale profits, unlike other investments, may be eligible for capital gains exemptions provided certain requirements are met. These requirements include that 1) you must live in the house as your primary residence, and 2) you must have owned it for at least 1 year.

The IRS provides a $250,000 tax-free exemption on capital gains from a primary residence to everyone regardless of their income. This capital gain can be permanently deducted from your income. For example, if you are your spouse buy a home for $100,000 and sell it for up to $600,000 years later, you won’t incur any capital gains tax.

What’s my capital gains tax rate?

Long-term capital gains tax rates are determined by your income. Prior to 2018, they were determined by tax brackets. For example, if your annual income is less than $40,400 in 2021, you can take advantage of the 0% capital gains tax. The 15% capital gains rate, which applies to incomes between $40,401 and $445,850, will apply to the majority of single people. Long-term capital gains will be taxed at a rate of 20% for single filers with incomes above $445,851.

The brackets for married couples filing jointly are a little higher, but most will be hit with the marriage penalty. The good news is that married couples with earnings of $80,800 or less are still in the 0% tax bracket. Married couples earning between $80,801 and $501,601 will pay a capital gains tax of 15%. Those with incomes exceeding $501,601 will be subject to a 20% long-term capital gains tax.

- Your tax rate is 0% on long-term capital gains if you’re a single filer earning less than $40,400, married filing jointly earning less than $80,800, or head of household earning less than $54,100.

- Your tax rate is 15% on long-term capital gains if you’re a single filer earning between $40,401 and $445,850, married filing jointly earning between $80,801 and $501,600, or head of household earning between $54,101 and $473,750.

- Your tax rate is 20% on long-term capital gains if you’re a single filer earning more than $445,851, married filing jointly earning more than $501,601, or head of household earning more than $473,751. For those earning above $501,601, the rate tops out at 20%.

A short-term gain is if you only kept the property for a year or less. Short term capital gains are taxed at ordinary income rates. That’s the same tax rate you’d pay on other types of regular income, like wages.

Do renovations reduce capital gains?

You can deduct the cost of home modifications from the amount of capital gains payable to capital gains tax. You can calculate your adjusted cost basis by adding the amount you spent on any home renovations (i.e. fixing the roof, installing a deck, changing the floor) to the initial purchase of your property. The lesser your capital gain when you sell your house, the greater your adjusted cost basis is.

For example, if you bought your home for $500,000 and sold it for $800,000, but you invested $100,000 on home upgrades over the years. That $50,000 would be deducted from your home’s sale price, so instead of paying capital gains taxes on the $300,000 profit from the sale, you’d only have to pay taxes on the $250,000 profit. You’d meet the criteria for capital gains tax exclusion in that situation and you’d owe no taxes.

Remember to save receipts for any modifications you make to your house since they can assist with decreasing your taxed income when you decide to sell your house. Keep in mind, though, that these must be house renovations. Ordinary repairs and maintenance on your home are not deductible from your income.

Capital Gains on Inherited Homes

If you are selling a family home that you inherited, the IRS provides a “free step-up in basis.” This means that you pay capital gains tax on only the difference between what you sell the house for and what it was worth when your last parent passed away. For example, your parents paid $100,000 for the family home years ago and it’s now worth $1 million when you inherit it. When you sell, the purchase price when you sell it, or “basis”, is the $1 million it is worth on the last parent’s death date and not the $100,000 that your parents paid.

What If My Home Sells at a Loss?

You can’t deduct a capital loss if you sell your primary house for less than what you bought it for. A capital loss from the sale of your home is considered a personal loss, and it does not lower your taxable income.

However, if you sell other real estate as a loss, you can deduct the loss on your tax return. You may be limited in the amount of loss you can use to offset other taxable income in a given year.

How Investors Avoid Capital Gain Tax

Avoiding capital gains tax can be a little more tricky if the home you’re selling isn’t your primary residence but rather an investment property you’ve flipped or rented out. However, it is still feasible. If you’re an investor, the best approach to avoid capital gains tax is to use a 1031 exchange to transfer “like-kind” properties. This permits you to sell your home and buy another without having to pay any capital gains taxes in the year of the sale.

It is important to note however that there are very rigorous timelines and requirements with a 1031 exchange, so consult an accountant before proceeding. You will face capital gains on the profit if you opt out of the rental property investment business and invest your money in something that doesn’t qualify for a 1031 exchange.

Resource

5 Tax Deductions to Take When Selling a Home

You may recall that in 2018, the new Tax Cuts and Jobs Act changed some restrictions for homeowners. However, if you sold your house in 2021 or plan to sell in the future, your tax deductions can still save you a lot of money when you file your taxes with the IRS. Here is the complete list of all tax deductions as well as tax exemptions and other write-offs that are available to Sellers.

Selling Costs

These deductions are allowed if they are related to the sale of the home and you lived in the home for at least two of the five years before the sale. Another stipulation is that the home must be used as a primary dwelling rather than an investment property.

You can deduct all expenditures related with selling the home, such as legal fees, escrow fees, advertising charges, and real estate agent commissions. Just keep in mind that these expenses are deducted from the sale price of your house, which lowers your capital gains tax liability (more information on that below).

Home Improvements and Repairs

Yes you read that right! You can deduct all upgrading and repair costs if you renovated the property prior to going on market to make your property more valuable. However, these expenses need to have been completed within 90 days of the closing.

Property Taxes

If you paid your property taxes on time up until you sold your house, you can deduct up to $10,000 in property taxes paid for the previous year. Remember that sellers can only deduct interest on up to $750,000 of mortgage debt under the 2018 tax code. However, homeowners who received their mortgage before December 15, 2017 can continue to deduct up to the original amount of $1 million.

The mortgage interest and property taxes are itemized deductions, therefore to take the most advantage of this all your itemized deductions need to be greater than the new standard tax deduction. To complicate things, in 2021, those amounts increased to $12,550 for individuals, $18,800 for heads of household, and $25,100 for married couples filing jointly.

Mortgage Interest

You can deduct the interest on your mortgage for the portion of the year you owned your home, much like property taxes. Remember that sellers can only deduct interest on up to $750,000 of mortgage debt under the 2018 tax code. However, homeowners who received their mortgage before December 15, 2017, can continue to deduct up to the original $1 million.

The mortgage interest property taxes are itemized deductions. Therefore, to take the most advantage of this all your itemized deductions need to be greater than the new standard tax deduction.

Also note that in 2021, those amounts increased to $12,550 for individuals, $18,800 for heads of household, and $25,100 for married couples filing jointly.

Capital Gains Tax

Even though the capital gains rule is technically an exclusion and not a deduction, it is still something you can appreciate. Capital gains are the proceeds from the sale of your home after paying off your bills and any remaining mortgage debt, therefore these profits are taxed as income. The good news is that if you’re single, you can deduct up to $250,000 in capital gains from the sale, and if you’re married, you can deduct up to $500,000. The sole requirement is that you must have spent at least two of the previous five years in your current residence.

It is also important to keep in mind that capital gains are calculated based on the cost basis of your home and not the purchase price. The cost basis of your home is what you purchased the home for plus any investments on upgrades. For example, if you buy a house for $400,000 and invest $100,000 on upgrades, your cost base will be $500,000. After residing in the home for 2 years, a married couple may sell it for $500,000 and avoid paying capital gains taxes. The greater your cost basis, the lower your tax burden will be when you sell. Just keep a record of every home improvement receipt.

Lastly, be sure to keep an eye out for changes to the rules of this exemption in a future tax law.

Resources

How to Calculate Property Tax

Most individuals are aware that owning a home entails a substantial financial investment. There is your mortgage, but the expenses don’t stop there. You will also be responsible for paying property taxes.

If you already own a home, you can look at your most recent property tax statement to see how your tax is calculated. If you’re thinking about purchasing a house, you can search for the assessment and tax information on the real estate listing, or go to the City & County of Honolulu Real Property Tax website to found out the annual property tax (https://www.qpublic.net/hi/honolulu/search.html).

The City & County of Honolulu also provides a step-by-step on how to calculate real property taxes. Click here to view the link: https://www.realpropertyhonolulu.com/media/1623/how-to-calculate-real-property-taxes-cch.pdf

How are property taxes determined

When determining property taxes, a variety of factors are taking into account, including the assessed value of your home and the mill levy (tax rate) in your area. Here’s how to figure out how much property tax you’ll have to pay so you don’t get caught off guard.

A Home’s Fair Market Value

The market value of a home is the amount that a knowledgeable buyer would pay a knowledgeable seller for a property in an arm’s-length transaction with neither party feeling compelled to buy or sell. When a property is sold to a third party, the sales price is usually deemed to equal the property’s fair market value.

A Home’s Assessed Value

The value of your home is one aspect that influences your property taxes. Tax municipalities will utilize your home’s assessed value. Tax appraisers can calculate the current assessed value of a residence once a year. When a property is sold, bought, built, or remodeled, they may adjust information by looking at the permits and documents submitted with the local municipality.

They will look at basic attributes of your property (such as acreage, square footage, and the number of bedrooms and bathrooms), the purchase price when it changes hands, and comparisons with similar properties in the area.

The assessed value of a home may be surprisingly comparable to its fair market value, but this isn’t always the case, especially in hot markets. In general, you can expect your home’s assessed value to be between 80% and 90% of its market value. For a more precise amount for your home, you can contact the Honolulu tax office at (808) 768-3799.

You can contest the value of your home for tax purposes if you believe the appraiser has given it an excessively high value. You don’t need to pay a professional to assist with lowering your property taxes. As a homeowner, you may be able to present how you arrived at the conclusion that your assessed value is incorrect.

Taxable Value

Your home’s taxable value is the worth of the property as determined by your assessment, without any modifications such as exemption amounts.

Mill Levy

You will also need to know the mill levy, which is the real estate tax assessment rate in your area. The tax rate varies significantly depending on the public services provided and the amount of income needed by the local government.

Your property tax rates will be greater if you have a public school, police force, full-time fire department, desired school districts, and plenty of playgrounds and parks than if you don’t. After all, you get what you’re taxed for!

Resource

7 Tax Benefits of Owning a Home

As you may know, there are many tax benefits of owning a home. However, you may be wondering if you are utilizing every benefit possible to help save you money during tax season. According to an article on Realtor.com, there are 7 tax benefits that you may not be aware of and should make use of!

1) Mortgage Interest

Mortgage interest is the most significant benefit of owning a home. If you obtained a mortgage before December 15, 2017, you can deduct interest a loan up to $1 million. If your mortgage incurred after December 15, 2017, you can deduct the interest on the first $750,000 if married and filed jointly, or $375,000 if filed as single. If your mortgage is $250,000, you don’t need to worry about this rule.

It is important to note that your mortgage interest deduction is considered an itemized deduction. Therefore, to take the most advantage of this all your itemized deductions need to be greater than the new standard tax deduction. Also keep in mind that the standard deduction amounts for the 2021 tax year have increased. Individuals can now deduct $12,550 (up $150 from 2020), while married couples filing jointly can deduct $25,100 (up $300 from 2020). The deduction for the head of the household has also increased to $18,800 (up $150 from 2020). If you’re 65 or older, you can add $1,350 per person if you’re married and filing jointly, or $1,700 if you’re the head of the household or a single filer. Make sure to confirm the standard deduction amounts as they may have changed from the time you are reading this.

To claim your mortgage interest deduction, your lender will send you a Form 1098 at the beginning of the year which will state the mortgage interest you paid during the previous year. This is the amount you will deduct on Schedule A (Form 1040). Also, don’t forget to include the interest you paid on your home closing. If this isn’t identified on your 1098, it will be on your Settlement Statement that was provided at closing. You can add this amount to your total mortgage interest paid.

2) Property Taxes

You can deduct state and local property taxes in the year you pay them. Before the Tax Cuts and Job Act went into effect on January 1, 2018, homeowners were able to deduct the entire sum of their property taxes. However, since then the maximum deduction is $10,000 for those married filing jointly, no matter how high the taxes are.

Just keep in mind that property taxes are included in that itemized list of all your deductions, which must total more than your standard deduction to be worthwhile. If you have a mortgage, keep in mind that your property taxes are included in your monthly payment.

3) Private Mortgage Insurance

Private Mortgage Insurance (PMI) is required if you put less than 20% down payment on your home, which costs from 0.3% to 1.15% of your home loan. The purpose of PMI is to reassure and protect the lender in case you default on your loan.

The good news is that the Mortgage Insurance Tax Deduction Act of 2021, which revived various deductions and credits for homeowners that were set to expire in 2020, has allowed for PMI holders to deduct the interest on this insurance.

This is important because the interest on PMI is an itemized deduction as well. However, if you qualify, it might help you surpass the $25,100 standard deduction for married couples under 65. For example, if you earn $100,000 and put down 5% on a $200,000 home, you will pay $1,500 in annual PMI premiums, thus lowering your taxable income by $1,500!

4) Energy Efficiency Upgrades

The Residential Energy Efficient Property Credit was a tax incentive for home improvements that used alternative energy sources. The majority of these tax benefits expired in December 2016, however two remain in effect. According to Josh Zimmelman, proprietor of Westwood Tax & Consulting in New York, the credits for solar electric and solar water heating systems are now accessible through December 31, 2023.

According to Fogel, the SECURE Act also reintroduced a $500 tax credit for a certain qualified energy efficient modifications “such as external windows, doors, and insulation.”

Even with solar energy, you can save a lot of money! Plus, since it’s a credit, there is no need to itemize. However, depending on the date of installation, the credit proportion changes. For example, 26% of the cost of equipment installed between December 31, 2019 and January 1, 2023 is eligible for the credit. After December 31, 2022 and January 1, 2024, the percentage will reduce to 22%. The credit is currently set to expire in 2024.

5) A Home Office

There’s more good news for self-employed individuals whose home office is their primary location of business: You can deduct $5 per square foot of office space up to 300 square feet, for a total deduction of $1,500.

However, there are very rigorous restrictions about what constitutes a dedicated, fully deductible home office space for those who qualify for the deduction. Here’s more information on the sometimes misunderstood home office tax deduction.

Unfortunately, you are not eligible for the home office deduction under the CARES Act if you are a W-2 employee, even if you spent most of 2021 in your home office. If you are a W-2 employee, an option might be to ask your company (and tax adviser) whether you can change your status from employee to independent contractor, which would allow you to continue collecting this deduction. However, it’s important to consider the benefits and drawbacks of this status change that is not solely based on the tax benefits.

If you are self-employed, you are eligible to claim a home office tax deduction. You will deduct a portion of your home expenses on your tax return by separating the costs of utilizing your property for personal and business uses. To qualify for the deduction, you must designate a portion of your house as your principal place of business and utilize it primarily for work. For example, it does not count if you work in a room that serves as a guest room when family or friends come to visit. If your desk is in a corner of your bedroom or is part of an open floor plan, you will need to measure the space you use for your office, including any walls. The key is that you must utilize the space exclusively for work and not to check personal email.

There are a couple methods to go about claiming a home office deduction. The first method is to calculate the amount of space in your home that you use for business purposes. As mentioned above, each square foot you use for work is worth $5 and you can claim up to 300 square feet every year for a total of $1,500. The second method is to keep track of all your home’s costs (i.e. upkeep, insurance, repairs, utilities, etc) as well as depreciation (normal wear and tear). Then divide and allot these expenses based on the percentage of your home that you use exclusively for business. For example, if your office space accounts for 10% of your total square footage, you can deduct 10% of your home costs. The key with this method is keeping careful records.

You do not need to worry about getting audited as the IRS simplified its method of measuring out your office space to take the audit scare out of the home office tax deduction.

6) Home Improvements

To qualify for this deduction, your home modifications must cost more than 7.5% of your adjusted gross income. For example, if you earn $60,000, you can deduct the money you spend over $4,500.

For many older homes who plan to age in place and add additions, such as wheelchair ramps or grab bars in the bathroom, the expense of these improvements might result in a nice tax break. Widening doorways, lowering cabinets or electrical features, and installing stairlifts are all examples of deductible improvements.

It is important to note that to establish that these adjustments were medically necessary, you will need a note from your doctor.

7) Interest on a Home Equity Line of Credit (HELOC)

The regulations of home equity debt have altered drastically as a result of the 2018 Tax Cuts and Jobs Act.

According to the IRS, the interest you pay on a home equity line of credit, or HELOC, is deductible only if the loan is used exclusively to “purchase, develop, or improve a property.” So whether your house needs a kitchen makeover or a half-bath, you will save money. This is known as acquisition debt because it will almost certainly increase the value of your home.

However, if the loan is used for something other than buying, building, or substantially improving a house, then the interested paid is not deductible. For example, if you used your property as collateral to pay for college, a wedding, or a vacation. This is known as home equity debt and it is no longer tax-deductible. Before the new tax bill passed, you could deduct the interest on up to $100,000 of home equity debt as long as your total mortgage debt was less than $1 million. This is no longer allowed, even if you took out the loan before the new tax bill. All home equity obligations, as well as cash-out refinancing, are subject to the new tax law.

In the meanwhile, acquisition debt used to buy, build, improve a house is still deductible, but there is a limit. You can only deduct up to $750,000 in interest paid on your HELOC and mortgage combined. In addition, you can’t legally deduct interest if you took out a HELOC before the new 2018 plan for anything other than home improvements.

Be sure to seek the advice of an accountant to assist you in navigating and understanding the new tax laws.

Resource

https://www.realtor.com/guides/homeowners-guide-to-taxes/7-tax-benefits-of-owning-a-home/

https://www.realtor.com/guides/homeowners-guide-to-taxes/how-to-take-a-home-office-tax-deduction/

Hawai’i Creepy Crawlers

The Hawaiian Islands are known for their lush, green environment. But as with any temperate, tropical locale comes a host of creepy crawlers, flying vermin and buzzing, biting pests. I’m talking about the insects of Hawaiʻi. In addition to your standard mosquitoes, ants and flies, we also have cockroaches, termites and my least favorite—centipedes. Gross!

I get asked about our bugs by new Oʻahu homeowners a lot, especially when it comes to protecting their property. I recommend that folks hire a pest control service. These professionals help keep insect infestations at bay. And for homeowners that live on the Windward or East side of Oʻahu, which tends to get more rain and is a more humid environment, I recommend that people plug their drains at night. It creates an easy barrier to prevent insects, particularly cockroaches, from getting inside. And lastly, make sure kitchen counters, cupboards and floors are tidy. Mess attracts critters! Here’s a round-up of Hawaiʻi’s most common insects.

Cockroaches

As the saying goes, “a cockroach can outlive anything,” these bugs are certainly resilient and prevalent throughout the Islands! Did you know that there are 19 different species of cockroaches that exist in Hawaiʻi?! But only three to four types are considered invasive pests. My least favorite is the really big ones; locally we call them B-52s, after the Air Force bomber! These ones fly and have been known, albeit rarely, to even bite. You’ll more likely see them during the evenings and at night. To avoid them making a home in your home, be sure not to leave food out and plug drains at night.

Centipedes

I hate centipedes. Just thinking about them now makes me shudder. My husband, Mike has even been bit by one! The most common centipede in the Islands, and the one to really look out for, is the Scolopendra subspinipes, also known as the “Vietnamese Centipede or the “Large Centipede.” These creepy crawlers are brownish-red, and adults can grow to 6 inches to 9-inches, or even longer! Like cockroaches, you’ll most likely see centipedes at night. The venom from their bites can hurt like a bee sting, and may even cause an allergic reaction. Centipedes love warm, damp environments.

Termites

There are termites on every Hawaiʻi Island. These small pests love to munch away on wood. In particular, the dry wood and Formosan subterranean and dry wood termites are known to cause damage to homes across the Islands. Researchers with the University of Hawaiʻi College of Tropical Agriculture & Human Resources estimate that termites cause more than $100 million in damage to structures in Hawaiʻi each year. Again, it’s important to consult with a professional pest control service, especially if you suspect that you have an infestation.

While Oʻahu may be home to many unwelcome insects, there is good news. Thanks to our geographic isolation, the Islands don’t have any land snakes, far fewer poisonous spiders such as the toxic brown recluse, and we have only one species of scorpion, the lesser brown scorpion, but it is a rare sight on Oʻahu.

O’ahu’s Best Surf Spots

When it comes to sports in Hawaiʻi, surfing reigns supreme. Native Hawaiians didn’t invent surfing—other Polynesian societies were simultaneously experimenting with boards on waves—but Hawaiians certainly mastered and later popularized the concept of he‘e nalu, or wave sliding, aka surfing. It remains an integral part of Hawaiian culture and local society today. Here are my favorite surf spots on Oʻahu.

Note: Surfing on Oʻahu can be dangerous, so be sure to heed ocean safety signs and bear in mind your personal health and fitness before you paddle out. Remember to also be respectful of your fellow surfer.

Pipeline

Pipeline is the most famous surf break in world. I’m not a surfer and I’m familiar with this fabled North Shore spot! Pipeline is home to the Billabong Pipeline Masters, a big-wave surf contest held each year on Oʻahu, where the world’s best surfers compete. During the winter, this surf break is for experts and professionals only.

Queens

This surf break is the epitome of Waikīkī surfing. Queens got its name from Hawaiʻi’s last ruling monarch, Queen Liliʻuokalani, who resided near the surf break. This surf spot is popular with visitors trying to catch their first wave, as well as locals who live nearby. Surfing legends like Duke Kahanamoku grew up riding these waves. It’s a crowded spot, so watch out!

Ala Moana Bowls

Ala Moana Bowls has long been considered one of the best waves in town. This is my son Jon’s favorite place to surf! Ala Moana Bowls is a left-breaking reef wave that’s man-made. It was formed in the 1950s when the Kewalo Basin and the Ala Wai Small Boat Yacht Harbor joined together. Coral and dirt were extracted during construction, thus forming a “bowl” and creating its iconic tube waves. Respected surfers like Buttons Kaluhiokalani, Larry Bertlemann and Gerry Lopez frequented Bowls, as it’s known, creating a new style of surfing in the 1970s.

Publics

This is one of the most consistent South shore breaks. Publics gets its name from the public restroom facilities that used to exist adjacent to the beach. The surf break is a left-breaking wave and during the summer, when the swells rise on the South Shore, it becomes one of my son Jon’s favorite breaks. Beware: Publics can only be surfed during high tide since the area becomes too shallow to paddle in or out during low or medium tide.

Mākaha

Located on Oahu’s west side, Mākaha is a powerful break with a storied history. The break is thought to be birthplace of big-wave surfing and home to the Mākaha International Surfing Championship, first founded in 1954. Renowned Oʻahu surfers such as George Downing and Buzzy Trent pushed the boundaries of surfing here, catching towering swells. During its tamer days, you can spot bodyboarders and paddlers in outrigger canoes, in addition to surfers on short- and longboards, all enjoying the waves.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link